While in our program, here are a few things you should do to ensure the best results as well as set yourself up for success in the future. Some of these may not apply to your case and you should call us if there are any questions.

Credit is not taught in school, and is one of the fundamentals of our society. Most people have to learn about credit by trial and error and it should not be that way. Credit is merely a tool to use to assist you in getting some of the best financing around, better jobs, cheaper insurance, and opens many opportunities. Following our instructions while in the program will help you yield better results.

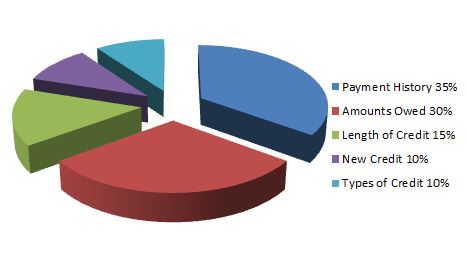

One of the main reasons we focus on credit card debt is because this area has one of the biggest impacts on your credit scores next to your pay history on your accounts. When you can address a number of these areas at once, you can see results in your scores quicker. Here are the 5 factors your scores are based off of:

Payment History - 35%

Credit Utilization - 30%

Length of Credit History - 15%.

New Credit - 10%

Types of Credit - 10%

As you can see, 65% of your scores are tied up in your payment history and credit utilization (Revolving Debt). If you are maxed out, over the limit or over 30% of your limit, you're score is most likely being hit. Suppose you were maxed out, and had a late payment show up on your credit report? This would have a very Large Impact on your score as your risk of default has greatly increased.

When you close cards, this also increases your credit utilization. For instance, if you had two cards, each with a $250 balance on them, and each with a $1000 limit, you would be at 25% utlization. If you closed one card, and still owed a balance on it, you would now be at 50% of utilization since you owe $500 and have a limit of $1000.

While in our program, we will continue to work closely with you to ensure that you are working towards your credit goals. But more importantly, we want you to lean on us regarding any credit questions you may have to optimize your results.

The only thing stopping you from achieving better credit is you! Maintaining a good credit profile is important in this credit driven world. Let us help you achieve your dreams and get you on the right path to good credit!

Once you are complete with our program please remember to use your credit wisely. Stay within your means, only use your credit cards when you need to, pay them down and off regularly, and be careful not to over extend yourself. Remember, the richest man is not the one who has the most, but the one who needs the least.